---

title: "Fine-tuning with a Specific Loss Function"

description: "Learn how to fine-tune a model using specific loss functions, configure the Nixtla client, and evaluate performance improvements."

icon: "gear"

---

## Fine-tuning with a Specific Loss Function

When you fine-tune, the model trains on your dataset to tailor predictions to

your specific dataset. You can specify the loss function to be used during

fine-tuning using the `finetune_loss` argument. Below are the available loss

functions:

* `"default"`: A proprietary function robust to outliers.

* `"mae"`: Mean Absolute Error

* `"mse"`: Mean Squared Error

* `"rmse"`: Root Mean Squared Error

* `"mape"`: Mean Absolute Percentage Error

* `"smape"`: Symmetric Mean Absolute Percentage Error

## How to Fine-tune with a Specific Loss Function

[](https://colab.research.google.com/github/Nixtla/nixtla/blob/main/nbs/docs/tutorials/07_loss_function_finetuning.ipynb)

### Step 1: Import Packages and Initialize Client

First, we import the required packages and initialize the Nixtla client.

```python

import pandas as pd

from nixtla import NixtlaClient

from utilsforecast.losses import mae, mse, rmse, mape, smape

```

```python

nixtla_client = NixtlaClient(

# defaults to os.environ.get("NIXTLA_API_KEY")

api_key='my_api_key_provided_by_nixtla'

)

```

### Step 2: Load Data

Load your data and prepare it for fine-tuning. Here, we will demonstrate using

an example dataset of air passenger counts.

```python

df = pd.read_csv('https://raw.githubusercontent.com/Nixtla/transfer-learning-time-series/main/datasets/air_passengers.csv')

df.insert(loc=0, column='unique_id', value=1)

df.head()

```

| | unique_id | timestamp | value |

| ----- | ----------- | ------------ | ------- |

| 0 | 1 | 1949-01-01 | 112 |

| 1 | 1 | 1949-02-01 | 118 |

| 2 | 1 | 1949-03-01 | 132 |

| 3 | 1 | 1949-04-01 | 129 |

| 4 | 1 | 1949-05-01 | 121 |

### Step 3: Fine-Tune the Model

Let's fine-tune the model on a dataset using the mean absolute error (MAE).

For that, we simply pass the appropriate string representing the loss function

to the `finetune_loss` parameter of the `forecast` method.

```python

timegpt_fcst_finetune_mae_df = nixtla_client.forecast(

df=df,

h=12,

finetune_steps=10,

finetune_loss='mae', # Select desired loss function

time_col='timestamp',

target_col='value',

)

```

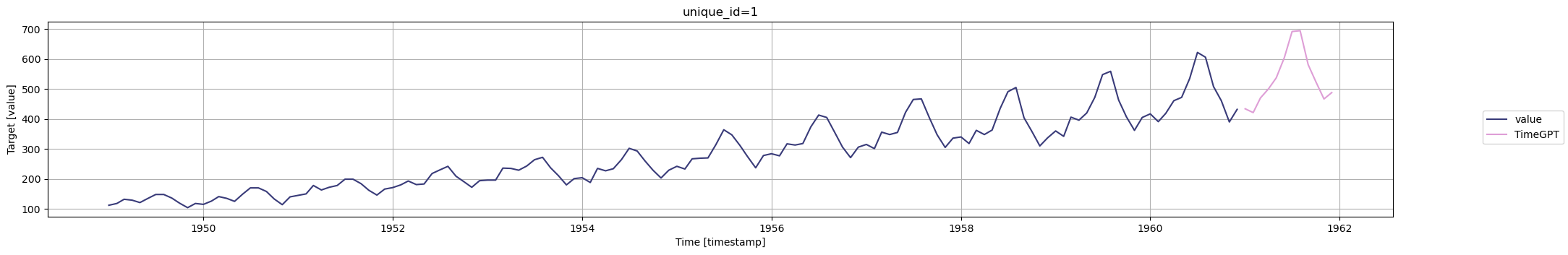

After training completes, you can visualize the forecast:

```python

nixtla_client.plot(

df,

timegpt_fcst_finetune_mae_df,

time_col='timestamp',

target_col='value',

)

```

## Explanation of Loss Functions

Now, depending on your data, you will use a specific error metric to accurately

evaluate your forecasting model's performance.

Below is a non-exhaustive guide on which metric to use depending on your use case.

**Mean absolute error (MAE)**

= \frac{1}{H} \sum^{t+H}_{\tau=t+1} |y_{\tau} - \hat{y}_{\tau}|) - Robust to outliers

- Easy to understand

- You care equally about all error sizes

- Same units as your data

**Mean squared error (MSE)**

- Robust to outliers

- Easy to understand

- You care equally about all error sizes

- Same units as your data

**Mean squared error (MSE)**

= \frac{1}{H} \sum^{t+H}_{\tau=t+1} (y_{\tau} - \hat{y}_{\tau})^{2}) - You want to penalize large errors more than small ones

- Sensitive to outliers

- Used when large errors must be avoided

- *Not* the same units as your data

**Root mean squared error (RMSE)**

- You want to penalize large errors more than small ones

- Sensitive to outliers

- Used when large errors must be avoided

- *Not* the same units as your data

**Root mean squared error (RMSE)**

= \sqrt{\frac{1}{H} \sum^{t+H}_{\tau=t+1} (y_{\tau} - \hat{y}_{\tau})^{2}}) - Brings the MSE back to original units of data

- Penalizes large errors more than small ones

**Mean absolute percentage error (MAPE)**

- Brings the MSE back to original units of data

- Penalizes large errors more than small ones

**Mean absolute percentage error (MAPE)**

= \frac{1}{H} \sum^{t+H}_{\tau=t+1} \frac{|y_{\tau}-\hat{y}_{\tau}|}{|y_{\tau}|}) - Easy to understand for non-technical stakeholders

- Expressed as a percentage

- Heavier penalty on positive errors over negative errors

- To be avoided if your data has values close to 0 or equal to 0

**Symmetric mean absolute percentage error (sMAPE)**

- Easy to understand for non-technical stakeholders

- Expressed as a percentage

- Heavier penalty on positive errors over negative errors

- To be avoided if your data has values close to 0 or equal to 0

**Symmetric mean absolute percentage error (sMAPE)**

= \frac{1}{H} \sum^{t+H}_{\tau=t+1} \frac{|y_{\tau}-\hat{y}_{\tau}|}{|y_{\tau}|+|\hat{y}_{\tau}|}) - Fixes bias of MAPE

- Equally sensitive to over and under forecasting

- To be avoided if your data has values close to 0 or equal to 0

With TimeGPT, you can choose your loss function during fine-tuning as to

maximize the model's performance metric for your particular use case.

## Experimentation with Loss Function

Let's run a small experiment to see how each loss function improves their

associated metric when compared to the default setting.

Let's split the dataset into training and testing sets.

```python

train = df[:-36]

test = df[-36:]

```

Next, let's compute the forecasts with the various loss functions.

```python

losses = ['default', 'mae', 'mse', 'rmse', 'mape', 'smape']

test = test.copy()

for loss in losses:

preds_df = nixtla_client.forecast(

df=train,

h=36,

finetune_steps=10,

finetune_loss=loss,

time_col='timestamp',

target_col='value')

preds = preds_df['TimeGPT'].values

test.loc[:,f'TimeGPT_{loss}'] = preds

```

Great! We have predictions from TimeGPT using all the different loss functions.

We can evaluate the performance using their associated metric and measure the

improvement.

```python

loss_fct_dict = {

"mae": mae,

"mse": mse,

"rmse": rmse,

"mape": mape,

"smape": smape

}

pct_improv = []

for loss in losses[1:]:

evaluation = loss_fct_dict[f'{loss}'](test, models=['TimeGPT_default', f'TimeGPT_{loss}'], id_col='unique_id', target_col='value')

pct_diff = (evaluation['TimeGPT_default'] - evaluation[f'TimeGPT_{loss}']) / evaluation['TimeGPT_default'] * 100

pct_improv.append(round(pct_diff, 2))

```

```python

data = {

'mae': pct_improv[0].values,

'mse': pct_improv[1].values,

'rmse': pct_improv[2].values,

'mape': pct_improv[3].values,

'smape': pct_improv[4].values

}

metrics_df = pd.DataFrame(data)

metrics_df.index = ['Metric improvement (%)']

metrics_df

```

| | mae | mse | rmse | mape | smape |

| ------------------------ | ------ | ------ | ------ | ------- | ------- |

| Metric improvement (%) | 8.54 | 0.31 | 0.64 | 31.02 | 7.36 |

From the table above, we can see that using a specific loss function during

fine-tuning will improve its associated error metric when compared to the

default loss function.

In this example, using the MAE as the loss function improves the metric by

8.54% when compared to using the default loss function.

That way, depending on your use case and performance metric, you can use the

appropriate loss function to maximize the accuracy of the forecasts.

- Fixes bias of MAPE

- Equally sensitive to over and under forecasting

- To be avoided if your data has values close to 0 or equal to 0

With TimeGPT, you can choose your loss function during fine-tuning as to

maximize the model's performance metric for your particular use case.

## Experimentation with Loss Function

Let's run a small experiment to see how each loss function improves their

associated metric when compared to the default setting.

Let's split the dataset into training and testing sets.

```python

train = df[:-36]

test = df[-36:]

```

Next, let's compute the forecasts with the various loss functions.

```python

losses = ['default', 'mae', 'mse', 'rmse', 'mape', 'smape']

test = test.copy()

for loss in losses:

preds_df = nixtla_client.forecast(

df=train,

h=36,

finetune_steps=10,

finetune_loss=loss,

time_col='timestamp',

target_col='value')

preds = preds_df['TimeGPT'].values

test.loc[:,f'TimeGPT_{loss}'] = preds

```

Great! We have predictions from TimeGPT using all the different loss functions.

We can evaluate the performance using their associated metric and measure the

improvement.

```python

loss_fct_dict = {

"mae": mae,

"mse": mse,

"rmse": rmse,

"mape": mape,

"smape": smape

}

pct_improv = []

for loss in losses[1:]:

evaluation = loss_fct_dict[f'{loss}'](test, models=['TimeGPT_default', f'TimeGPT_{loss}'], id_col='unique_id', target_col='value')

pct_diff = (evaluation['TimeGPT_default'] - evaluation[f'TimeGPT_{loss}']) / evaluation['TimeGPT_default'] * 100

pct_improv.append(round(pct_diff, 2))

```

```python

data = {

'mae': pct_improv[0].values,

'mse': pct_improv[1].values,

'rmse': pct_improv[2].values,

'mape': pct_improv[3].values,

'smape': pct_improv[4].values

}

metrics_df = pd.DataFrame(data)

metrics_df.index = ['Metric improvement (%)']

metrics_df

```

| | mae | mse | rmse | mape | smape |

| ------------------------ | ------ | ------ | ------ | ------- | ------- |

| Metric improvement (%) | 8.54 | 0.31 | 0.64 | 31.02 | 7.36 |

From the table above, we can see that using a specific loss function during

fine-tuning will improve its associated error metric when compared to the

default loss function.

In this example, using the MAE as the loss function improves the metric by

8.54% when compared to using the default loss function.

That way, depending on your use case and performance metric, you can use the

appropriate loss function to maximize the accuracy of the forecasts.